Why Owner Earnings Works

Accounting profit, also known as net income, is one of the most widely watched metrics in evaluating the financial health of a company. It's the profit after various costs are subtracted from total revenue as stipulated by generally accepted accounting principles (GAAP). However, the cost of equity capital is not included in this calculation. Wall Street treats equity capital for free.

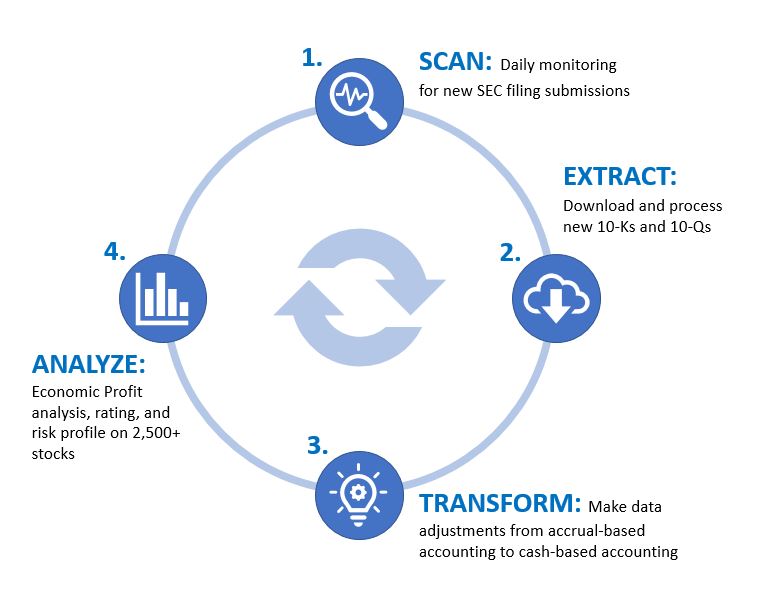

The metric we use to evaluate performance is Owner Earnings. Owner Earnings is similar to accounting profit in that it deducts various costs from revenue, but is different because it also includes the cost of equity capital. An important part of our Owner Earnings model is recognizing that access to equity capital is an expense and comes at a cost. In fact, costs of equity capital can and do vary with the overall sustainability risks of the company.

Simply, accounting profit does not account for all costs and any evaluation based on this method is incomplete. It is also a common knowledge that net income is easily manipulated by companies to manage earnings (i.e. paper profits).

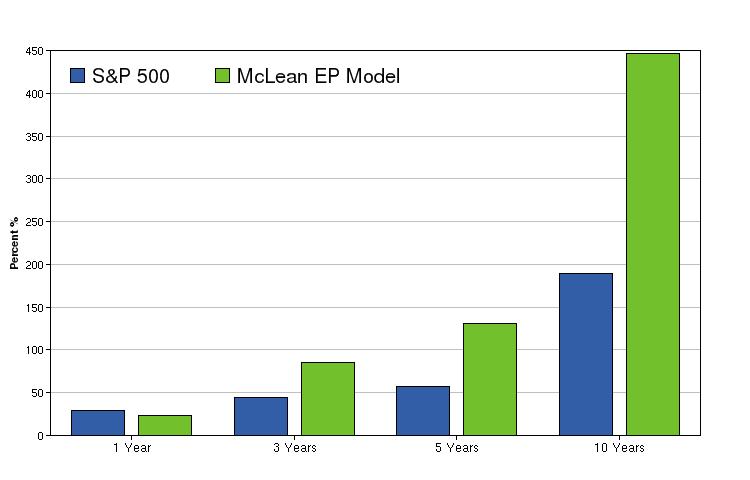

Our research shows that the best way to evaluate the true secondary of a company is using an Owner Earnings approach. Companies that continuously generate Owner Earnings achieve long-term secondary, and that secondary will be recognized by our Owner Earnings analysis.

Sign Up Today